State Compliance Guide

Introduction

PROPOSED STATE AND LOCAL LABOR REGULATIONS ARE ADDING TO ALREADY CHALLENGING FEDERAL RULE COMPLIANCE.

Managing compliance with federal labor laws is difficult enough for HR and payroll managers given constantly changing regulations and the ongoing list of pending legislation. Add individual state and local labor requirements to that mix and it’s no wonder that those responsible for maintaining compliance and processing payroll within their organization shake their heads and struggle to keep up.

If you are moving your organization to a new area or are kicking off operations in a locale where you haven’t done business before, it’s important to make sure you know what you’re getting into. There are six major employment areas that can easily trip up business leaders when their organizations venture into new locations or states. Read on to learn what you need to know about the labor laws in certain areas, how you can ensure your operation is following all labor law regulations, and how to make the right business decisions regarding your employees to ensure they’re accurately paid.

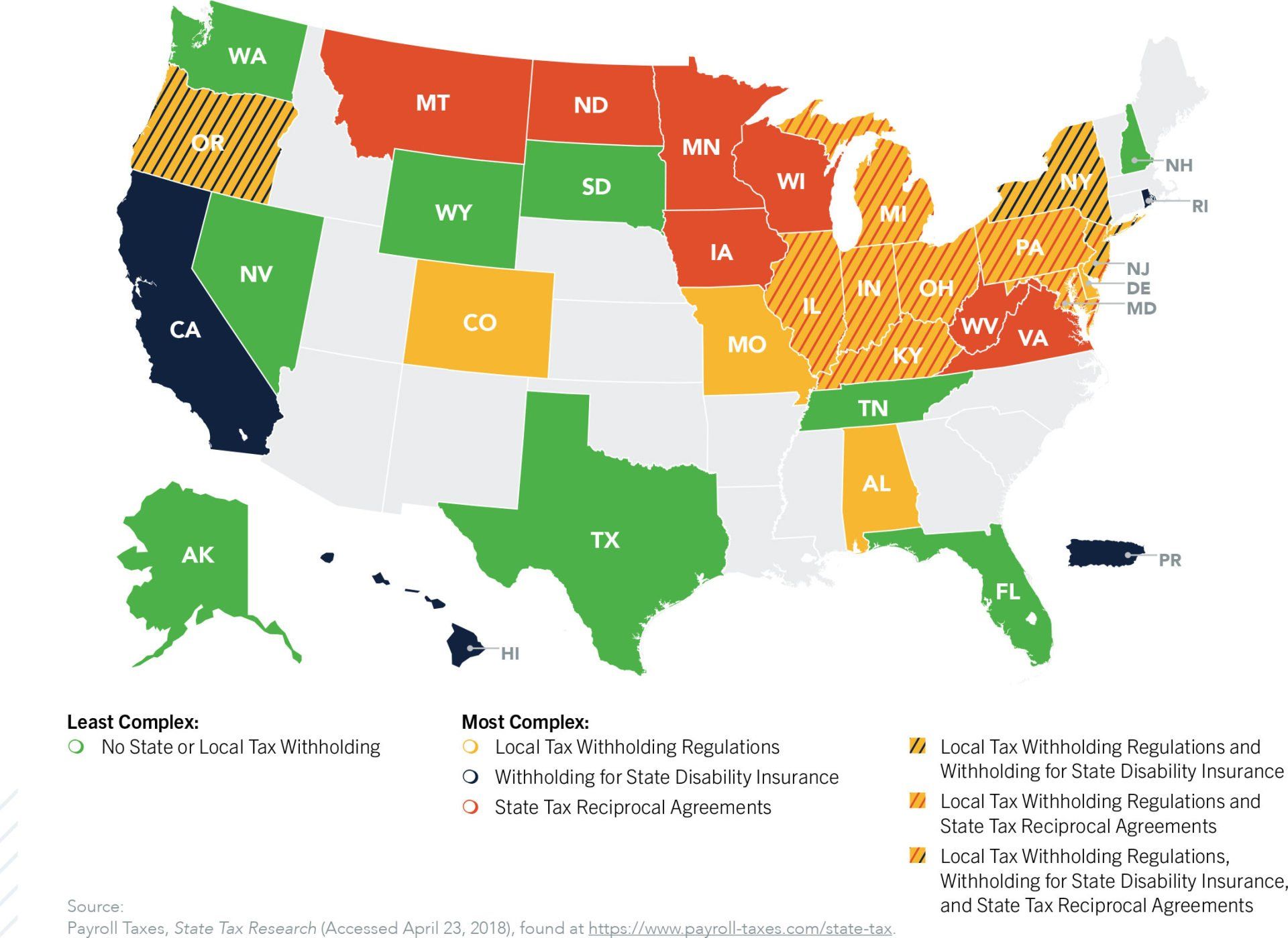

State and Local Tax Withholding and Reciprocity

WITHHOLDING STATE AND LOCAL TAXES FROM EMPLOYEE PAY SOMETIMES CAN BE TRICKY.

When an employee works in one city or state but lives in another, reciprocity agreements may allow an employer to withhold taxes based on residency, not on work location. Knowing which states or cities allow this and which don’t can be overwhelming. If your organization has operations in any of the states with complex withholding or reciprocity regulations, then you need to pay special attention to these regulations.

MAKING TECHNOLOGY WORK FOR YOU

Don’t be faced with fees, fines, and penalties for not complying with tax agency requirements. Invest in technology that understands the complexities of tax withholding and remitting. Alleviate the burden of managing to different regulations by using modern payroll technology. You can distinguish taxation based on employee residency and work locations — and handle multistate

taxing. And when your payroll and timekeeping systems are on a single platform, capturing accurate time- and location-worked information becomes a seamless process. Using the technology, you can easily withhold the correct amount from each employee’s paycheck and remit the appropriate amount to each taxing agency.

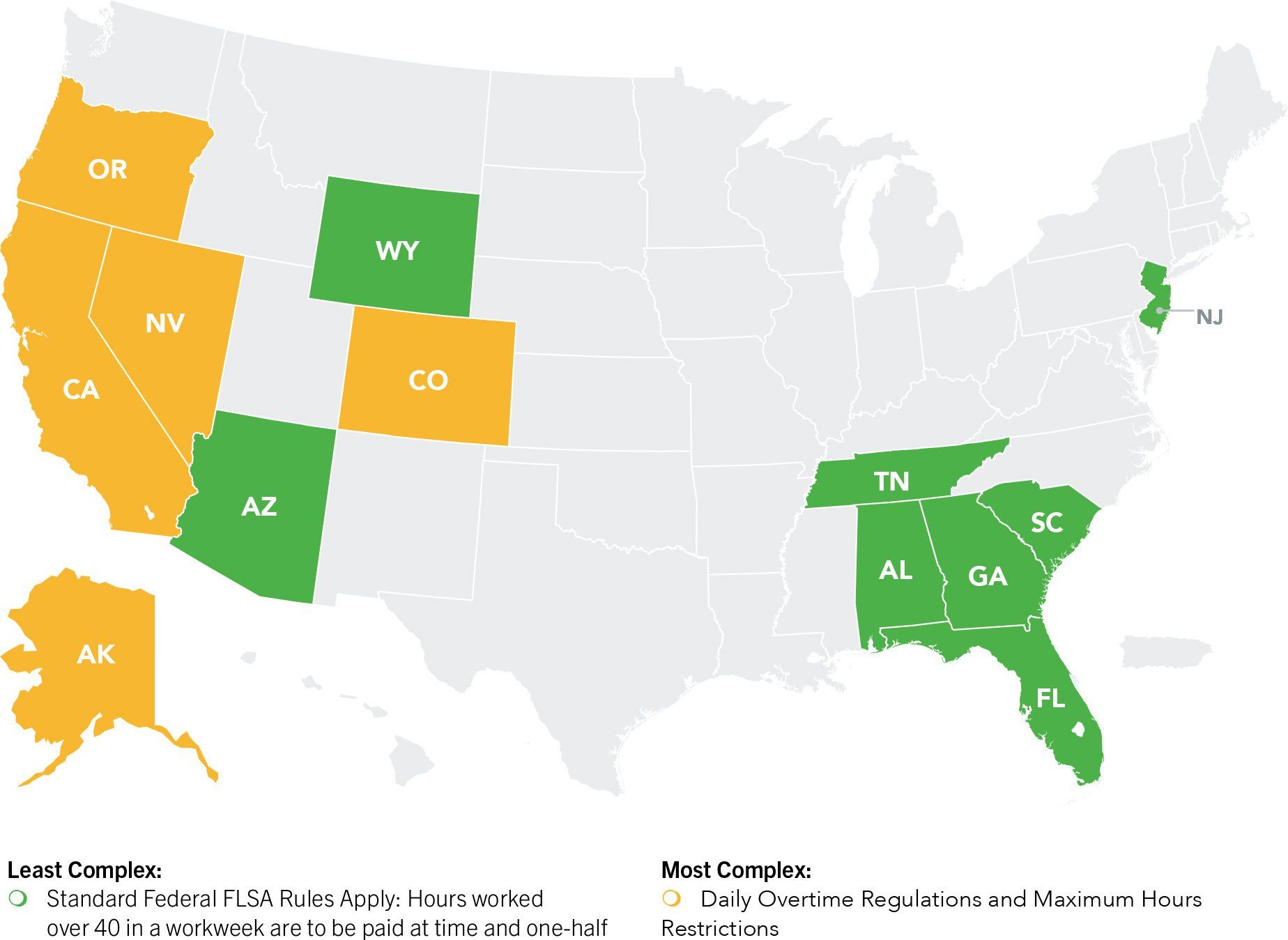

Overtime Complexities

INACCURATE OVERTIME TRACKING AND CALCULATIONS CAN LEAD TO NONCOMPLIANCE PENALTIES.

Although tracking employee wages and overtime can be challenging, it’s critical for employers to understand pay rules and how they impact not only an employee’s pay but also the organization through the imposition of possible fines, fees, and penalties for noncompliance. Most states follow the federal rules set forth under FLSA (Fair Labor Standards Act), but there are exceptions. While no state can require less than the federal FLSA rules, states can create more employee-friendly regulations. These exceptions can quickly create issues for an employer.