Ventana White Paper: Make Finance Accounting Cool

Make Finance and Accounting Cool

Technology Can Make the Department More Strategic

Make Finance and Accounting Cool

Let’s make finance and accounting cool. Wait — cool? Yes! Let the department liberate the rest of the company by cutting down on tedious and unnecessary administrative tasks. Let’s automate the time-consuming work that keeps people in the department from being more productive. Let’s reduce the chance of billing errors that can annoy customers or reduce revenues. Let’s minimize the risk of unintended material errors occurring in financial statements. Let’s make sure that executives and managers have rapid, easy access to up-to-the minute information to support agility in responding to opportunities and issues.

How? Technology. Not whiz-bang, futuristic technology but practical, proven and affordable software designed specifically to meet the demanding needs of midsize companies. Of course, technology by itself won’t make accounting cool. There are people, process design and process management aspects that departments must address. But technology — especially the core financial management or ERP system — can be the catalyst that makes all the above possible, practical and within reach of any midsize company. And that technology can be more affordable, more manageable and easier to use than you and your department might think.

When It’s Time to Change

Changing a financial management or ERP system is a serious undertaking. For this reason, companies don’t typically make a change until it’s necessary. However, there comes a point in the evolution of every midsize company when its financial management or ERP system is no longer adequate to support the company or its management. Typically, one of the three following situations signals that it’s time for a change.

An organization should consi- der a new financial manage- ment or ERP system when it has outgrown its entry-level accounting package, or when its existing mid-size company application has become obso- lescent. Another sign is when the CFO or controller of a rapidly expanding company recognizes the need to get ahead of the problem of financial management or ERP system replacement while dealing with growth management.

In any of these situations, it’s critical that organizations recognize the benefits of making the move.

When It’s Time to Change

While it may appear that financial management or ERP systems are essentially the same as they’ve been for decades, a steady stream of improvements has significantly improved these systems’ performance and capabilities.

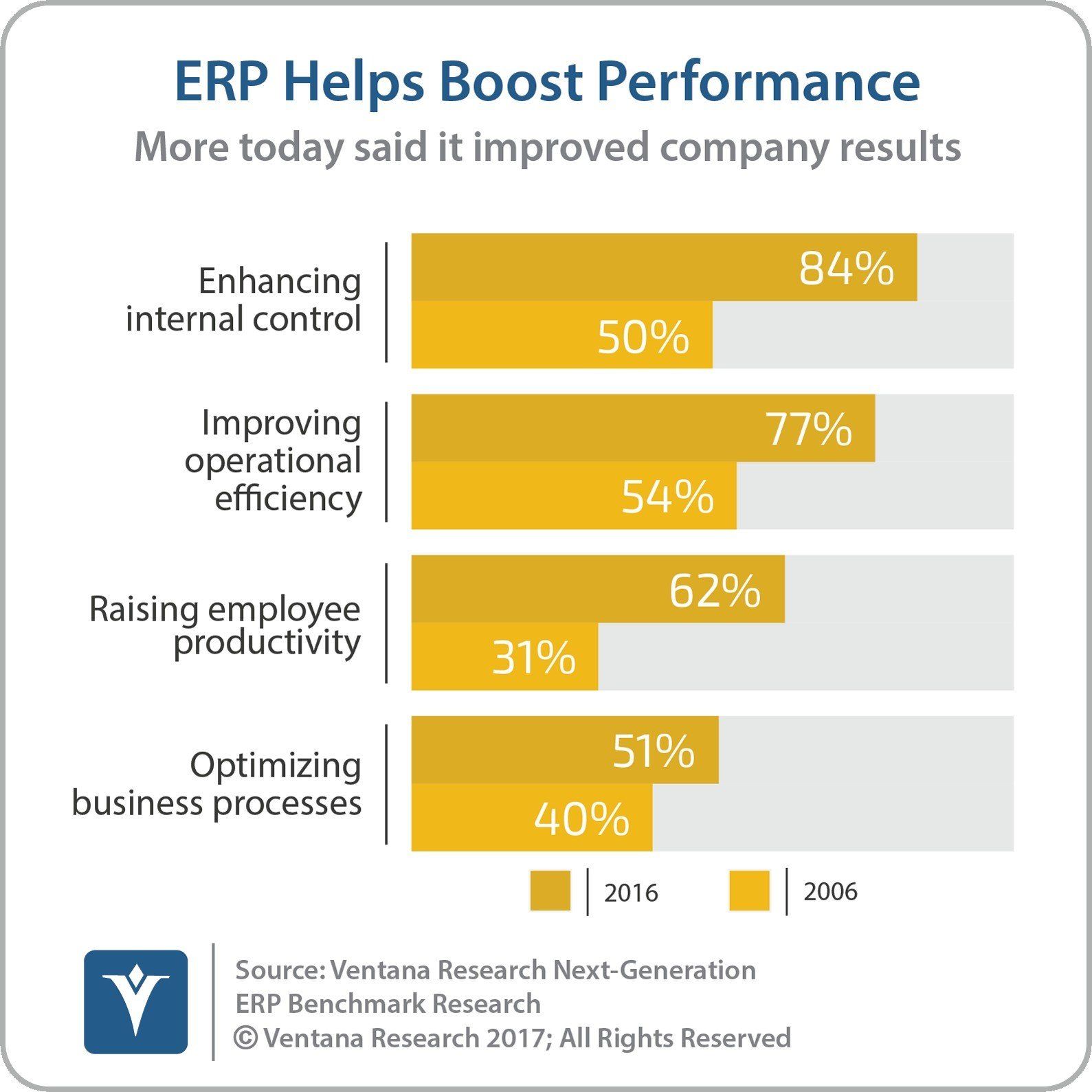

Finance executives must understand what’s possible with today’s software. Our Next-Generation ERP benchmark research reveals that more than three-fourths (77%) of organizations said that their financial management or ERP system has improved operational efficiency. Nearly two-thirds (62%) indicated that it had increased employee productivity, and more than four out of five partici- pants said it enhances internal controls. Moreover, 55 percent of organizations said it’s easy or very easy to get infor- mation out of their system, compared to only 11 percent a decade earlier.

Today’s technology makes people more efficient and processes more effective. Information is more readily available to managers and executives when they need it. A modern financial manage- ment or ERP system can be the foundation that enables a department to make accounting cool.

Adopt a Continuous Accounting Approach

To eliminate the need for unproductive work and thus enable individuals to focus on the things that matter, organizations must adopt a continuous accounting approach that takes advantage of technology. The concept of continuous accounting rests on three pillars:

- Accelerate the close and reduce department stress with technology that distributes department workloads continuously across periods.

- Use technology to support a continuous, end-to-end process and data management to enhance efficiency and increase data integrity.

- Instill a continuous improvement mindset to overcome inertia and the “we’ve always done it this way” attitude.

This approach eliminates the need for time-consuming and unproductive work because when an organization automates repetitive work that machines handle faster and more accurately, it better ensures data accuracy and reduces the need for reconciliations and checks. There is less chance of material errors because financial data quality is built into the process. When organizations take this approach, the data required for reporting, analyses and billing is accurate, consistent and available sooner.

Technology Makes Finance Cool

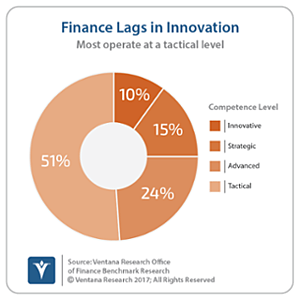

When organizations no longer need to engage in unproductive tasks, CFOs and controllers are better able to make the department a more strategic partner that improves a company’s performance. Technology makes this possible. However, this sort of innovation requires a shift in attitude. Finance departments pose a particular challenge: Our Office of Finance benchmark research finds that half of finance and accounting depart- ments are technology laggards. Half (51%) are at the lowest level of profi- ciency and only 10 percent are at the highest.

Companies that have maintained entry- level accounting software or a legacy financial management or ERP system for too long should know that today’s soft- ware can deliver significant enhance- ments. This means more information that executives and managers need to run the business, so companies can grow without adding administrative headcount.

In the past, buying and implementing a financial management or ERP system and all the necessary hardware required a daunting cash outlay; companies needed a staff to manage it all. Not anymore. Today, cloud-based software as a subscription (SaaS) removes those barriers and provides a more secure computing environment. So, let’s make accounting cool.

About Ventana Research

Ventana Research is the most authoritative and respected benchmark business technology research and advisory services firm. We provide insight and expert guidance on mainstream and disruptive technologies through a unique set of research-based offerings including benchmark research and technology evaluation assessments, education workshops and our research and advisory services, Ventana On-Demand. Our unparalleled understanding of the role of technology in optimizing business processes and performance and our best practices guidance are rooted in our rigorous research-based benchmarking of people, processes, information and technology across business and IT functions in every industry. This benchmark research plus our market coverage and in- depth knowledge of hundreds of technology providers means we can deliver education and expertise to our clients to increase the value they derive from technology investments while reducing time, cost and risk.

Ventana Research provides the most comprehensive analyst and research coverage in the industry; business and IT professionals worldwide are members of our community and benefit from Ventana Research’s insights, as do highly regarded media and association partners around the globe. Our views and analyses are distributed daily through blogs and social media channels including Twitter, Facebook and LinkedIn.

To learn how Ventana Research advances the maturity of organizations’ use of information and technology through benchmark research, education and advisory services, visit www.ventanaresearch.com.

Learn More

or Call Now 800-352-4032